Source-www.dreamgetsystem.in

In last nifty report we have expressed our view of nifty weekness ,market behaved from last 15 days same,

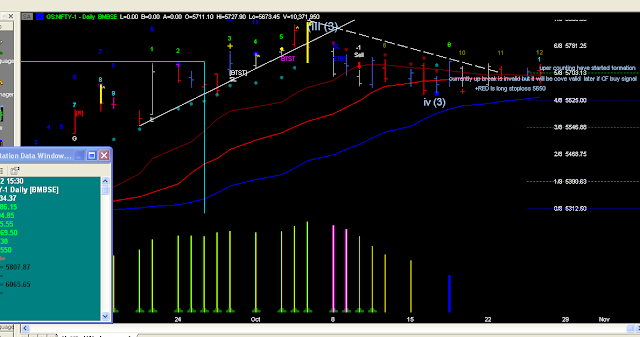

on time wise consolidation phase looks going on over ,as up couting in white colore has started .

so now down pending target is ruled out

go with current up mo momentum

inner ivth is completed around red line and inner vth up wave of some kind of impulisve up wave is pending

also time wise yellow or blue up counting 13 is pending

closing above +5/8 level5 703 will lead market to new high 5800 >6065 put trade stoplss 5650